FAQ's

Levels are posted daily in 🐋┃⚓┃killer-whales, please scroll or use the search function at the top right to find levels from a specific time.

Descriptions for levels are posted in the Killer Whales FAQ.

No, only for VIX and SPY, however after training you will be able to draw your own for any ticker.

No, you can sign up at any time but it’s advised to take the trainings first so you can understand and follow the call outs and coaching.

click the member list to the right scroll down to the bottom and click launch pass- enter your code there

You can cancel your subscription by clicking on the “unsubscribe” or “cancel now” link found at the bottom of the email invoice you were sent. It’s at the bottom in blue. (See Pic Below)

No, but the subscription is monthly, so you can cancel at any time before your renewal. Your renewal date is based on the day you signed up.

This Tier gives you access to K.D.W. and daily live training, live coaching, voice recordings, and The Wealth Whales podcast. (This is for daily access, it does not include any 1 on 1 trainings for V.V.P)

Here is what you get with the Killer Whales. Please read this entire page.

- Over 2 decades of experience

- Daily Pre-Market Prep LIVE – (Voice Channel)

- Daily Trade Thesis/ Plan for proper trade execution

- K.D.W.’s Levels for precise entries and exits

- Live Trading of the Open and Morning Session (Voice Channel)

- Live Trading of the entire day in the Tier 3 Killer Whales Chat

- Weekly Trade Setups and Call Outs

- First access to all call outs and swing positions

- LIVE discussion & recap for all trades

- LIVE discussion & training on skill development including mindset

- Weekly Mental Development

First access to all Mentoring and Coaching programs

The voice chat schedule is located in 📅┃voice-chat-schedule

KD does post his call-outs however the voice channel is the best way to receive the quickest notification. His entries are called in the live voice chat, then briefly typed in chat…. most of the time

Swings are not posted every day but usually there are a few swing trades per week, when the market has normal volatility. They can be found in the tier 3 killer whales access.

Wealth Whale focus on execution and consistency so we share daily our wins and losses as opposed to profits. Most use the following format: # of wins/total # of trades taken. Killer Whales also provide a daily grade with notes about execution that day. This is a culture of progress, not perfection.

The voice chat schedule is located in 📅┃voice-chat-schedule

Check your settings (phone/computer) and make sure your sound is turned on.

No, but anyone in the group is free to share trades they are taking, Even with KD’s callouts, you should not follow blindly.

KD does post his call-outs in the chat most of the time, however the voice channel is the best way to receive the quickest notification. SPY moves quickly and the time it takes to type everything can result in missed opportunities.

We use a trading system called V.V.P. which is mentioned in 🎥┃video-trainings and taught here 📝┃1-on-1-bookings .

We use the 3-minute time frame for intraday trades. Never the 1 minute. This is discussed more in depth in training.

KD’s contract selection parameters are as follows:

Delta of .30 or higher

ATM or ITM contracts

3-5 DTE

KD uses his VVP system to draw his levels. You can learn to create your own levels by taking training, Go to 📝┃1-on-1-bookings to sign up and get a better understanding of why those levels are there.

As each person account size is different, strike prices are not mentioned. The technique is the same for everyone. No matter your account size, you will be able to enter your own trades. We wouldn’t want anyone to think they need to risk more money than they should.

KD uses hot keys and is usually in a trade instantly. There will always be an audio delay between the time the trade was entered and said. The important thing is the contract that you chose.

Typically, KD’s first trades of the day are with 3-5 DTE contracts. 0 DTEs are sometimes used later in the day, but are not recommended for new traders or those not yet consistently profitable.

LTB = Load the boat = buy more contracts than you normally would (buy 5 instead of 2), NOT full port.

To effectively manage risk, we use the Divide and Conquer (DAC) risk management strategy developed by KD to encourages reasonable position sizing, stop losses, and profit taking. To implement, divide your account by 10 to get your position size – example: $1000/10 = $100. The maximum position size in this case is $100 per trade. Ultimately, the choice is yours but starting smaller and slower is smart

Profit is taken at or around your levels, once several key market factors like Volume and Price Action are taken into consideration. (Listen to the daily live market sessions or schedule 📝┃1-on-1-bookings to gain a solid understanding of when we hold and sell.) Profit is taken using a limit bid order, market order (if the spread is narrow), or trailing stop — depending on the move. Check out these videos as well (link)

Trading View (TV)

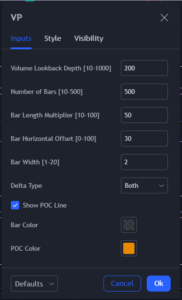

Volume by Price: KD uses the free volume profile by kv4coins on Trading View. Feel free to use the TV link here for a discount code: 📝┃trading-resources

Volume by Time:

Think or Swim (TOS)-users

Volume by Price: Volume Profile

Volume by Time: VolumeAvg

KD does not use the Volume Profile in TOS (should we include what we use for those that use TOS?)

Point of Control – the price level with the heaviest volume. It is visible on a volume profile.

KD uses Trading View for charting and volume profile and TOS for trade execution.

He uses ____ for futures.

He talks about his set-up in 🎥┃video-trainings and 📝┃1-on-1-bookings

KD can trade anything but the focus of the discord is SPY. Because of

YES! However our main focus is to day-trade Spy, but we will day trade and SWING other tickers. Usually weekly, Look for call out for other tickers in the 💬┃general-chat and past swings in the 🐋┃✅┃swings-options

Volume varies, so use the volume avg study in TOS to gauge where the relative volume is for the current session, ( See PIC below) if I see the volume below the average line = I consider it Low Volume, if it is above the average line = I consider it Better but would still be cautious incase there are sharp pops and drops in volume that day, If I see it well above the average line comparable to the opening and closing volume of previous days = I consider it Good Volume, and can trade as I normally do. Volume is discussed at length in training #0![]()

We do not use lagging indicators. See this video for more information (link)

No, he uses Level 2 and Time and Sales data. However, other traders do. You can ask in the general chat for members who would be willing to share information.

Go to 📝┃1-on-1-bookings. Make sure you scroll up to see the links and common questions.

Trainings must be taken in order. All trainings are live and conducted on Zoom. The training is not lecture-based, it is a two-way conversation and training. The trainings are small group sessions and KDW will not leave any questions unanswered — please have your questions ready! You will need a computer, smartphone, or tablet to see the training and talk with KDW. You will walk away from the training with tons of notes and homework. The more work you put into the homework, the better you will be. You are able to book training here: 📝┃1-on-1-bookings

Training 0

Foundational knowledge for V.V.P.

Understanding V.V.P.

What Moves the Market

Candle Stick Trading

Tying it all together

Training 1

Foundational Charting with VVP

How to use V.V.P to make trading decisions

How to use V.V.P for Perfect Entries, Exits and Avoiding Pain Points

Q&A

Training 2

Learn what to chart and watch, for perfect intraday trades.

Learn how to read the charts for perfect entries

Learn how use V.V.P., Market Indicators, and everything from trainings 0-3 for winning trades.

Q&A

Training 3

Learn what to look for before the market opens, to develop a proper daily trading plan.

Q&A

Training 4

Reading the Tape, Time and Sales,

Hidden Levels.

When to use Lagging Indicators & how to use them for this system

Q&A

Training 4.5

What are volume levels and how important are they

How to do Volume Time Frame Analysis

How to plot volume levels

When & How to adjust your volume levels

How these levels work along with price levels

How to use these levels to give yourself an edge

Q&A

Training 5

Understanding & Mastering the “550 Swing Trading System” For a (95% WIN RATE)

Entries and Exits

Q&A

When you sign up for trainings, the times will be specific to your time zone.

No, they are not. Make sure you take notes.

No, you will need to sign up again or sign up for a one-on-one with KD where he can answer any questions you have for trainings already taken.

Yes. Everything learned in training can be applied to other tickers.

You have to select the rooms you would like to be apart by selecting 🏁┃roles.

Have them try deleting server then adding it again and re-enter her code.

IF YOU ARE NEW, WELCOME! Follow these directions ——> Please read the ┃testimonials to see how this discord, the training, and mentoring has been helping traders become incredibly successful and consistent . Then go here first –> 🔑┃verify channel – to make sure you’re verified- then read the ┃rules channel to understand how we roll in here, (RULE #1. Don’t Kill The Vibe) then go to ┃roles channel and select/react to each channel you want to view and interact with- then go to the ┃video-trainings channel and watch the VIX, VOLUME, BONDS, & 3 Indicators Videos- Search through the video library and watch all the videos- then go to the ┃1-on-1-bookings and sign up for training – ( you have to take the trainings in order, YOU CANNOT SKIP –

Starting with #0, “New Whale” – We recommend you take the trainings together (meaning 0&1 then 2&3 then 4&4.5 together, however you can also take them 1 at a time, the choice is yours) Many have expressed that they grow faster by taking them together- – in the meantime jump in the SPY VOICE CHANNEL & the ┃spy-only-options-trading-room Mondays & Fridays from 8:50 AM to 12 Noon- for pre-market and live trading- Go here to see the live trading schedule 📅┃voice-chat-schedule – ALL OTHER TIMES & DAYS OF THE WEEK WE ARE TRADING LIVE IN THE Killer Whales PRIVATE CHANNELS WHERE KDW POST’S ALL OF HIS LEVELS AND DISCUSSES TRADE SET UPS ——–Are you ready… Then Let’s Go! @everyone

Algos = Algorithms

ATH = All-Time High

BP = Buying Power

DAC = Divide and Conquer

EOD = End of Day

FBM = Follow Big Money

HOD = High of Day

LOD = Low of Day

LTB = Load the Boat

MM = Market Makers

POC = Point of Control

PH = Power Hour

R/R = Risk/Reward

RTH = Regular Trading Hours

VP = Volume Profile

VVP = Volume Volatility Price

VWAP = Volume Weighted Average Price (edited)

The FAQ section (link). You can also ask questions in (help please), (general chat), or (submit a ticket)

Yes. You will need to determine which times work best for you. See this video/audio

There is a ton of value provided for free in the discord. You can check out some of the Wealth Whales videos here 🎥┃video-trainings and join us Mondays and Fridays in the SPY VOICE 🥽┃spy-only-options-trading-room for live trading that is available to everyone. You can get an idea of how we trade. If you are interested in the premium, Tier 3 access, you can then join the Killer Whales for call outs and coaching and you can sign up for training where you are ready here 📝┃1-on-1-bookings to sign up

8:50 am EST in the SPY only channel on Mondays and Fridays and in the Killer Whales room Tuesday – Thursday.

Weekly prep takes place on Sundays at 8:15 pm Eastern via Zoom. The link is sent out about 15 min prior. Please use your discord name for Zoom sessions.

Currently available on Amazon https://a.co/d/dQYgLTV

Swings are not posted every day but usually there are a few swing trades per week, when the market has normal to low volatility. They can be found here (link)

KD has a lot on his plate, so please contact any of our moderators first with Discord questions and concerns. You can also complete a ticket detailing your issue

Our moderators are:

@Grant

@Fluffle

@JBeastMode95

@sonnyjitsu

@LSG

KD and all of the moderators trade during the day. We try to get to your questions as soon as possible. However, you will likely receive responses during low-volume times of the day or once the market closes.

Mid-day poll

Post at 12:00 pm Eastern

@everyone REACT TO THIS MESSAGE: MID DAY POLL: ARE YOU RED OR GREEN OR NO TRADES SO FAR TODAY?

End of day poll

Post at 4:00 pm Eastern

@everyone REACT TO THIS MESSAGE: END OF DAY POLL: ARE YOU RED OR GREEN OR NO TRADES TODAY?